Uncover the Keys to Making Smart Decisions in Money Exchange Trading

As investors navigate the complexities of the market, they frequently seek out elusive tricks that can give them a side. By peeling off back the layers of this elaborate landscape, investors might discover surprise insights that might potentially change their strategy to money exchange trading.

Comprehending Market Trends

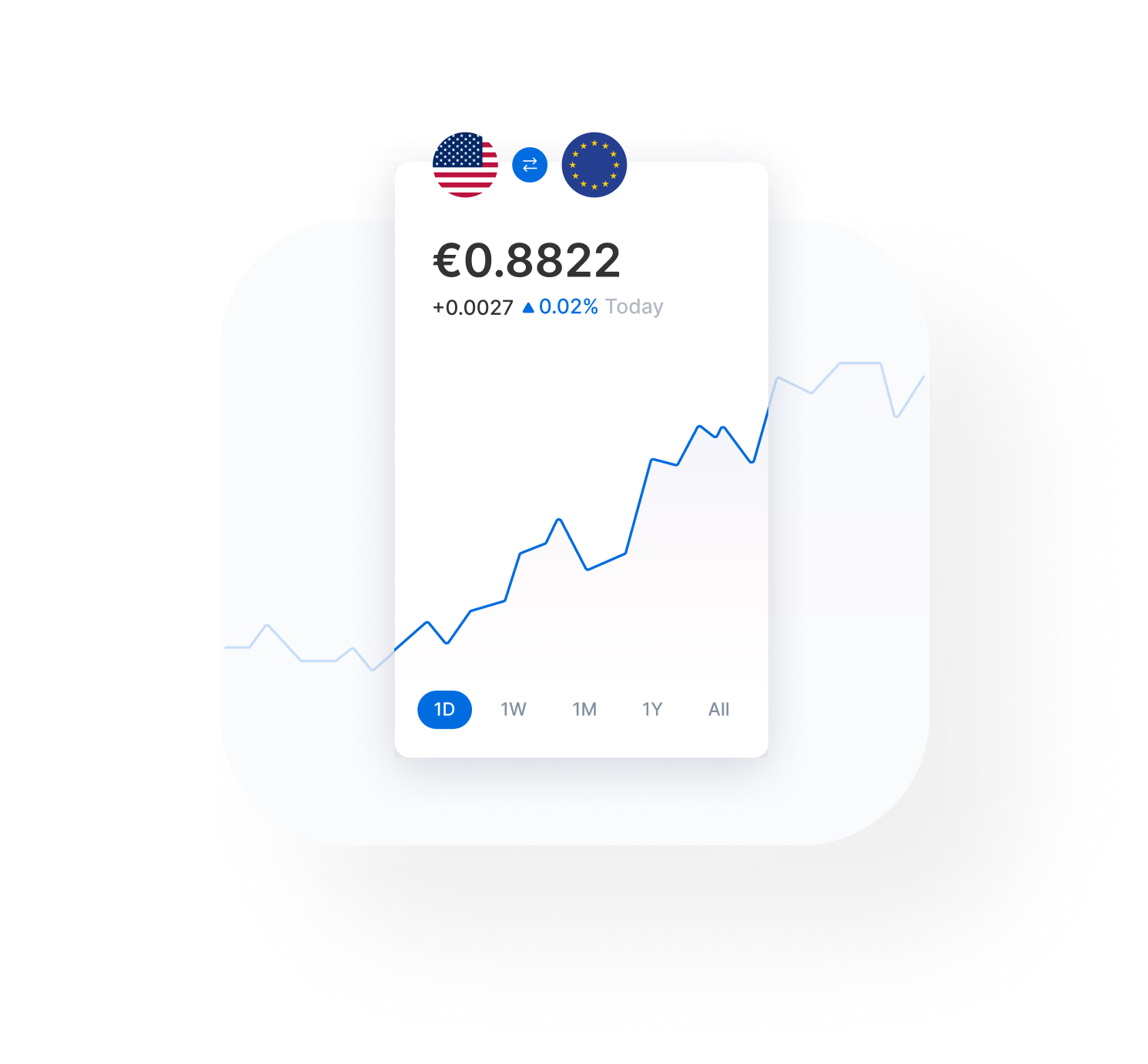

A thorough understanding of market patterns is critical for successful currency exchange trading. Market fads refer to the general direction in which the market is conforming time. By recognizing these trends, investors can make more enlightened decisions about when to purchase or offer currencies, eventually optimizing their revenues and lessening prospective losses.

To efficiently analyze market trends, traders typically make use of technological analysis, which includes researching historic rate graphes and using various indicators to predict future cost activities. currency exchange in toronto. Essential evaluation is also necessary, as it includes examining economic indicators, political events, and other factors that can influence money values

Danger Management Strategies

Just how can currency exchange traders successfully minimize potential risks while optimizing their investment opportunities? Executing robust risk monitoring methods is essential in the unpredictable globe of money exchange trading. One essential method is establishing stop-loss orders to limit losses in case the market relocates against an investor's position. By specifying the maximum loss they want to birth upfront, investors can shield their capital from considerable downturns. In addition, diversifying the portfolio throughout different currency sets can help spread out risk direct exposure. In this manner, an unfavorable influence on one currency set might be balanced out by positive movements in an additional.

Moreover, leveraging devices like hedging can better shield investors from damaging market activities. Inevitably, a disciplined and calculated approach to risk management is paramount for long-term success in currency exchange trading.

Essential Vs. Technical Analysis

The debate in between technical and fundamental evaluation has actually been ongoing in the trading area. Some traders choose essential evaluation for its concentrate on macroeconomic variables that drive currency values, while others prefer technological analysis for its focus on rate trends and patterns. In truth, successful traders often utilize a mix of both methods to get an extensive sight of the market. By integrating basic and technological analysis, investors can make even more educated decisions and boost their overall trading performance.

Leveraging Trading Devices

With a strong structure in essential and technical evaluation, currency exchange investors can considerably improve their decision-making process by leveraging various trading devices. These tools are made to offer investors with useful insights right into market trends, price movements, and possible entrance or leave factors. One vital trading tool is the financial schedule, which aids traders track vital financial occasions and announcements that can influence money worths. my explanation By staying informed regarding key financial indicators such as rate of interest rates, GDP records, and employment figures, traders can make even more enlightened decisions about their trades.

Psychology of Trading

Understanding the emotional elements of trading is necessary for money exchange investors to navigate the emotional obstacles and biases that can affect their decision-making process. The psychology of trading explores the state of mind of investors, dealing with problems such as worry, greed, overconfidence, and spontaneous habits. Emotions can shadow judgment, leading traders to make illogical decisions based on sensations rather than reasoning and analysis. It is important for traders to cultivate emotional technique and maintain a sensible strategy to trading.

One common emotional trap that investors fall under is confirmation predisposition, where they seek details that sustains their presumptions while disregarding inconsistent evidence. This can prevent their ability to adapt to altering market problems and make knowledgeable decisions. In addition, the concern of missing out on out (FOMO) can drive investors to go into trades impulsively, without carrying out correct research or evaluation.

Final Thought

Finally, understanding the art of money exchange trading needs a deep understanding of market fads, effective threat management strategies, understanding of technological and fundamental evaluation, utilization of trading devices, and awareness of the psychology of trading (currency exchange in toronto). By combining these aspects, investors can make informed choices and raise their opportunities of success in the volatile globe of currency trading

By peeling off browse around these guys back the layers of this detailed landscape, traders might uncover surprise understandings that could potentially transform their technique to currency exchange trading.

With a solid foundation in technical and basic evaluation, currency exchange traders can considerably enhance their decision-making procedure by leveraging numerous trading devices. One important trading device is the financial calendar, which helps investors track essential economic occasions and news that can influence currency worths. By leveraging these trading tools in conjunction try this web-site with fundamental and technological evaluation, money exchange traders can make smarter and more tactical trading choices in the dynamic forex market.

Comprehending the psychological facets of trading is crucial for money exchange investors to browse the psychological obstacles and biases that can affect their decision-making procedure.

Ralph Macchio Then & Now!

Ralph Macchio Then & Now! Rider Strong Then & Now!

Rider Strong Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now! Barbara Eden Then & Now!

Barbara Eden Then & Now! Dolly Parton Then & Now!

Dolly Parton Then & Now!